Recently, several of our International Banking clients have raised concerns about complying with emerging Legislation, EU Directives and other proposed rules that will enhance the Know Your Customer (KYC) rule.

ICI has developed a series of programmatic searches that are now being done by offshore facilities to proactively comply with what is expected to be a new, far reaching KYC rule. Some in the industry believe the sanctions against banks may be draconian in nature should a facility fail to comply.

This attempt to "self-regulate" is a means to deflate

the potential for advernturistic and restrictive legislation that

has emerged as a consequence to the tragic events in Washington

and New York.

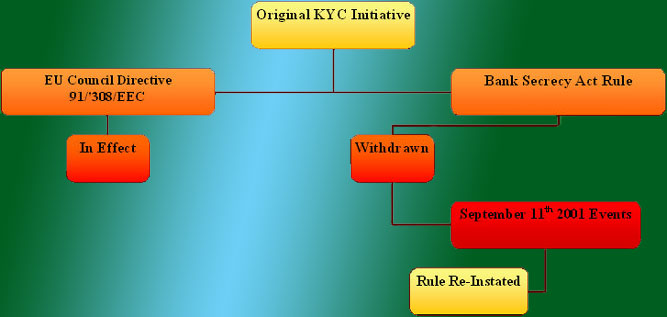

The foreign history of the KYC rule is found at EU Council Directive 91/'308/EEC of 10 June 1991 and was in response to a concerns over the international financial system being used as a vehicle to use of the financial system for money laundering purposes as published in the EU Official Journal L 166 , 28/06/1991 and found at p. 0077 - 0082. The full directive, its history and annotated statute can be found at:

http://europa.eu.int/scadplus/leg/en/lvb/l24016.htm

In the United States, a similar rule was attempted that would have essentially turned "your local banker into your local spy," according to some pundits. On December 7, 1998, the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, and Office of Thrift Supervision (the "Agencies") published for public comment a proposed KYC rule Public comment period for the proposal ended on March 8, 1999 and upon review, the Agencies reevaluated, and ultimately decided to withdraw it.

The Agencies received an unprecedented number of comments on the

proposal from the public, banking organizations, industry trade

associations, and members of Congress. Most of the comments reflected

public concern over the privacy of information that would be collected

and held by financial institutions, and many addressed the expected

burden the proposed rule would impose on banks and savings associations.

The Agencies were somewhat sensitive to not only to the concerns

raised by the critics, but also to the need to ensure that the institutions

regulated adhere to the nation's anti-money laundering statutes,

including the Bank Secrecy Act. The Agencies found that there must

be an appropriate balance between these legitimate interests. (See

12 CFR Parts 208, 211, and 225, Regulations H, K and Y; Docket

No. R-1019.

The Agencies were somewhat sensitive to not only to the concerns raised by the critics, but also to the need to ensure that the institutions regulated adhere to the nation's anti-money laundering statutes, including the Bank Secrecy Act. The Agencies found that there must be an appropriate balance between these legitimate interests. (See 12 CFR Parts 208, 211, and 225, Regulations H, K and Y; Docket No. R-1019.

An illustration of the KYC Initiative and its evolution, is abstracted below:

For a full text of the withdrawn rule, go to:

http://www.federalreserve.gov/boarddocs/press/boardacts/1998/19981207/R-1019.pdf

The Agencies' withdrawal of the proposed rule does not diminish in any manner their long-standing support for the anti-money laundering provisions of the Bank Secrecy Act. Over the past fifteen years, banking organizations and law enforcement authorities have forged a vital partnership to fight financial crime. This partnership will continue, and will evolve as technology and other factors intensify the challenges we face.

Following the events of September 11, 2001, the EU and its American

counterparts decided to resurface the aforementioned rule. It is now

expected that a more restrictive rule will be foisted upon the banking

community that will directly affect facilities that promise secrecy and a

high level of discretion. Thus, any bank operating in the international

community or having an "off-shore" facility, will be dramatically affected

by the proposed rule change.

Following the events of September 11, 2001, the EU and its American

counterparts decided to resurface the aforementioned rule. It is now

expected that a more restrictive rule will be foisted upon the banking

community that will directly affect facilities that promise secrecy and a

high level of discretion. Thus, any bank operating in the international

community or having an "off-shore" facility, will be dramatically affected

by the proposed rule change.

The most effective way to dilute the negative impact of regulations that are

born out of the suddenness of dark events is to quickly promote and

implement "self-regulation" on a voluntary basis. Our clients in Europe and

micro-Europe have turned to ICI for such a solution and we have perfected

the only process currently available that we are aware of.